Costly College

Many seniors are stressing over handling the financial burdens brought on by college acceptances. The girl in the illustration is sad because of these worries.

Thirteen acceptances and not a clue how to pay for them. The beginning of this year was initially filled with excitement, college acceptances were rolling in and the joy of my near future was overwhelming. That joy however, was soon overcome by the crushing reality of the situation. I had no way to pay for these schools.

Pell Grants, Scholarships, and student loans, there are so many options for how to pay for college but no clear way to navigate them. I have my school chosen but alas … that financial aid offer is proving to be a massive roadblock to my plans.

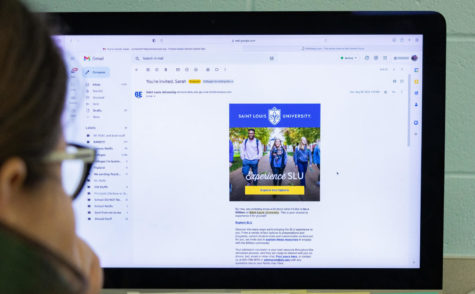

Saint Louis University is currently top of my list. On the 16th of February I had an opportunity to tour the school. I, like many other seniors this year, saw the school and pictured my future there. I came home so excited to start my future and tell my parents how I made my decision. Unexpectedly, instead of matching my energy, my parents’ faces immediately fell. SLU is expensive. We can’t afford that without significant aid.

So now I play the waiting game. March 1 is when I should be expecting the letter that displays my financial aid. It’s so sad that instead of an acceptance letter deciding my future it’s a stupid little email about loans.

I’m sure this is sounding redundant, a little whiny even, but I know so many students feel the same. I tell my classmates about what I’m writing about and the amount of people who are struggling with the same dilemma I am is astounding.

College costs are rising. Inflation is making affording it nearly impossible. In an article by CBS Minnesota, the cost of college now is compared to what it once was in 2002.

“According to the U.S. News and World Report, in 2002 the average yearly tuition at a four-year public university was $3,738. In 2022, it is $11,631. For a four-year private university, it was about $17,938 20 years ago. Today, it’s $43,775,” says CBS.

Cost has more than doubled for a degree and yes there is the ever-growing debate on whether a college degree is worth what it once was, but still at least there used to be a choice to easily attend college without burying yourself neck-deep in debt. I feel like I’m so close to starting my future but I’m being suffocated by a price wall. Senior year was meant to be fun and carefree, but now I find myself breaking down about what’s next. I don’t know what to do.

According to Rocket Mortgage, the average cost of a house is $285,956. The cost of a collegiate education is nearly double that.

“Considering student loan interest and loss of income, the ultimate cost of a bachelor’s degree can exceed $500,000,” according to Education Data Initiative.

Why is a requirement for nearly every career in the US cost more than a house? It’s insane how the economy has blocked so many students from secondary education. I’m one of the lucky ones, I live in a comfortable middle-class family, with parents and resources to help navigate this process, but so many don’t have that luxury. Many other students are left to try and figure out how to pay for school on their own. It is such a stressful time. Seniors just want to enjoy the victory of taking the next steps in their future, without having to worry about the economic burden they will be forced to take on.

The stress is alot, but it is not going to keep us down. Mentally things are rough and I am overwhelmed by everything, but this is not the end. We seniors are together in this fight, we work hard to apply for scholarships, we do everything we can to save. This mountain of expenses is not going to be the thing that buries us, afterall we survived a pandemic, we can survive this too.

Your donation will support the student journalists of Francis Howell Central High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs. FHCToday.com and our subsequent publications are dedicated to the students by the students. We hope you consider donating to allow us to continue our mission of a connected and well-informed student body.

Val Broste • Apr 2, 2023 at 12:22 pm

It breaks my heart that students are faced with a choice between getting their desired degree(s) and having a home and family. This at a time when we need more medical and mental health providers.